ct sales tax exemption form

The purchaser must complete CERT-125 Sales and Use Tax Exemption for Motor Vehicle or Vessel Purchased by a Nonresident of Connecticut Conn. Factors determining effective date thereof.

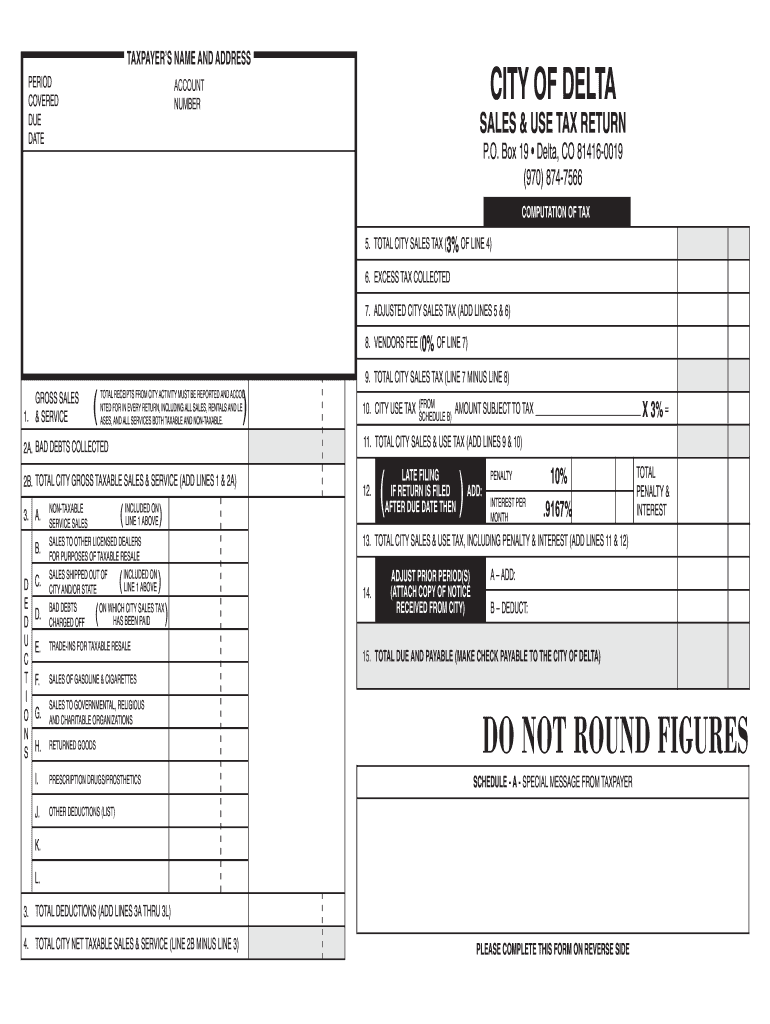

Co Sales Use Tax Return Fill Out Tax Template Online Us Legal Forms

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making.

. Printable Connecticut Purchases of Tangible Personal Property and Services by Qualifying Exempt Organizations Form CERT-119 for making sales tax free purchases in Connecticut. Training and funding provided. Amending a Sales and Use Tax Return.

2 Get a resale certificate fast. Table 1 lists the exempted. Sales tax or 2 outside Connecticut for use here ie use tax.

I further certify that if any property so purchased tax free is used or consumed by the firm as to make it subject to a sales or use tax we will pay the tax due direct to the proper taxing authority. 2 Get a resale certificate fast. Connecticut law provides for an exemption from Connecticut sales and use taxes for qualifying nonprofit organizations.

Tax Exemption Programs for Nonprofit Organizations. These taxes apply to any item of tangible personal property unless the law expressly exempts it. Application for Registration Agricultural Sales and Use Tax Certificate of.

You can download a. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Connecticut sales tax. CT ExemptNon-Exempt Status More Fillable Forms Register and Subscribe Now.

How to use sales tax exemption certificates in Connecticut. You can download a. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Connecticut sales tax.

The Department of Revenue Services to hold Live Virtual Event about the 2022 Child. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Connecticut sales tax. The Department of Revenue Services will be closed on Monday July 4 2022 a state holiday.

Application for Sales and Use Tax Exempt Entities or State and Federally Chartered Credit Unions. Sales Tax Exemptions in Connecticut. Ad Download Fill Sign or Email the file More Fillable Forms Register and Subscribe Now.

In Connecticut certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Child Tax Rebate - A new child tax rebate was recently authorized by the Connecticut General Assembly. Department of Revenue Services.

Over 300 stakeholders are membersadvisors to the Council including business leaders educators philanthropic and community-based organizations. A sales tax exemption. Dry Cleaning Establishment Form.

Manufacturing and Biotech Sales and Use Tax Exemption See if your manufacturing or biotech company is eligible for a 100 or 50 tax exemption. Ad 1 Fill out a simple application. The Department of Revenue Services to hold Live Virtual Event about the 2022 Child.

Connecticut law provides for an exemption from Connecticut sales and use taxes for qualifying nonprofit organizations. However this exemption does not apply to. Sales Tax Relief for Sellers of Meals.

Materials tools fuels machinery and equipment used in manufacturing that are not otherwise eligible for a sales tax exemption 50 of the gross receipts from such items 12-412i. Ad 100 Authorized by 70 leading semiconductor manufacturers -Buy Online or Call Today. Connecticut State Department of Revenue Services.

You can download a. Exemption from sales tax for services. Certain government agencies and transactions carried out by them in discharge of their functions are exempt from Connecticuts sales and use tax.

Exemptions from Sales and Use Taxes. Renewal of Your Sales Tax Permit. Ad 1 Fill out a simple application.

Partners with suppliers and authorized by over 70 leading semiconductor manufacturers. On making an exempt purchase Exemption Certificate holders may submit a completed Connecticut Sales Tax Exemption Form to the vendor instead of paying sales tax. Several exemptions are certain.

Child Tax Rebate - A new child tax rebate was recently authorized by the Connecticut General Assembly. Exemption from sales tax for items purchased with federal food stamp coupons.

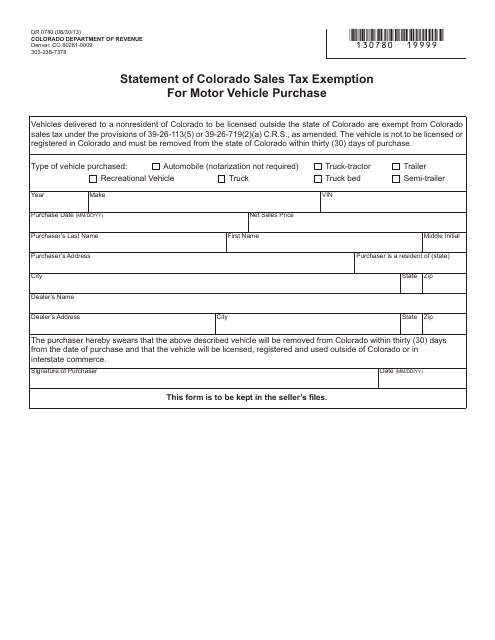

Form Dr0780 Download Fillable Pdf Or Fill Online Statement Of Colorado Sales Tax Exemption For Motor Vehicle Purchase Colorado Templateroller

How To Get A Sales Tax Exemption Certificate In Missouri Startingyourbusiness Com

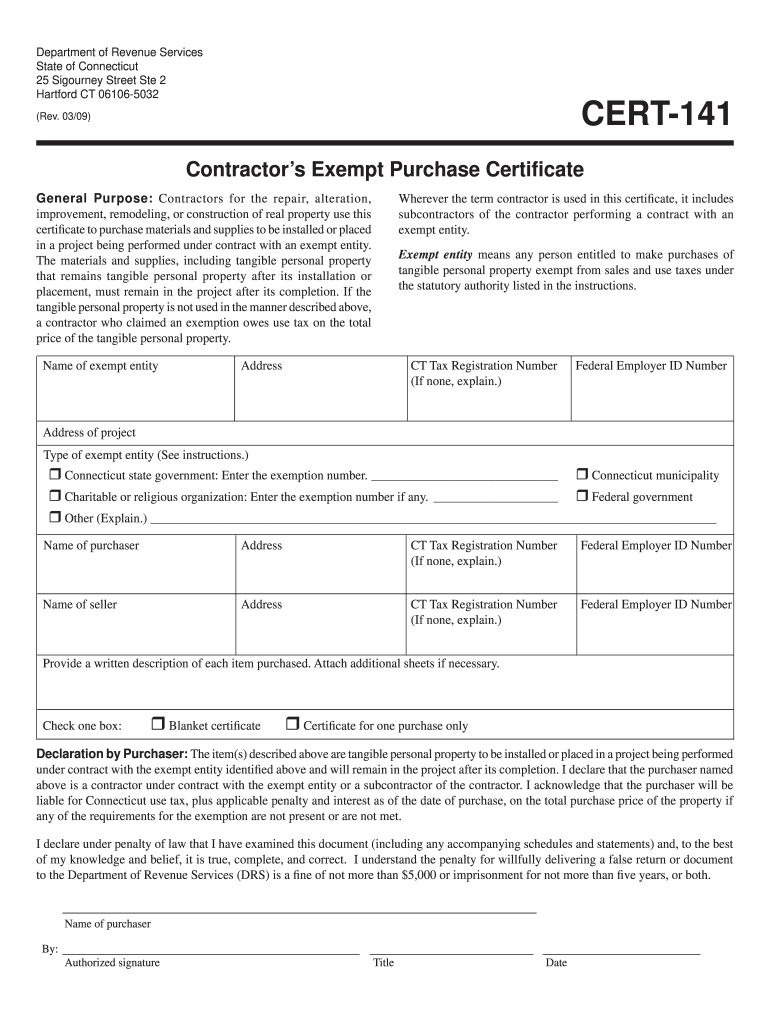

Ct Drs Cert 141 2009 2022 Fill Out Tax Template Online Us Legal Forms

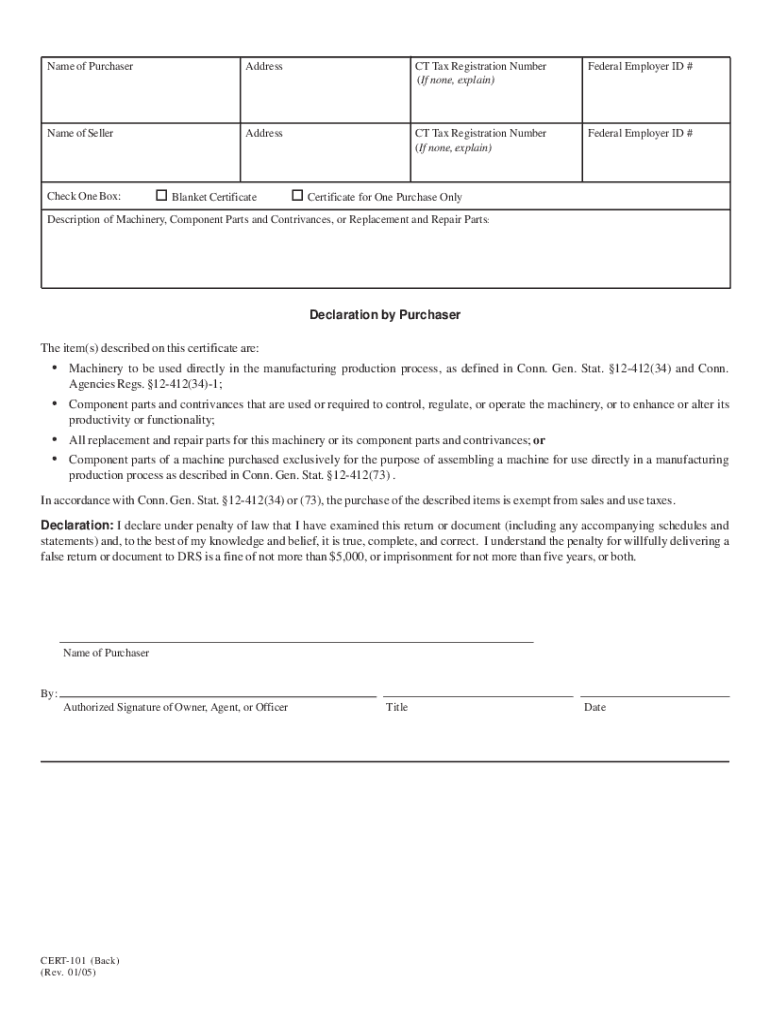

Cert 101 Fill Online Printable Fillable Blank Pdffiller

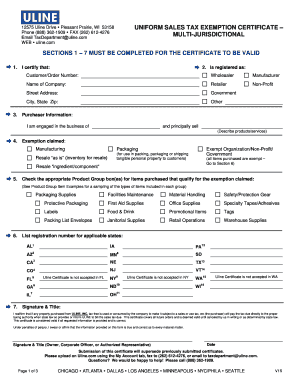

Fillable Multi Jurisdictional Tax Form Fill Online Printable Fillable Blank Pdffiller

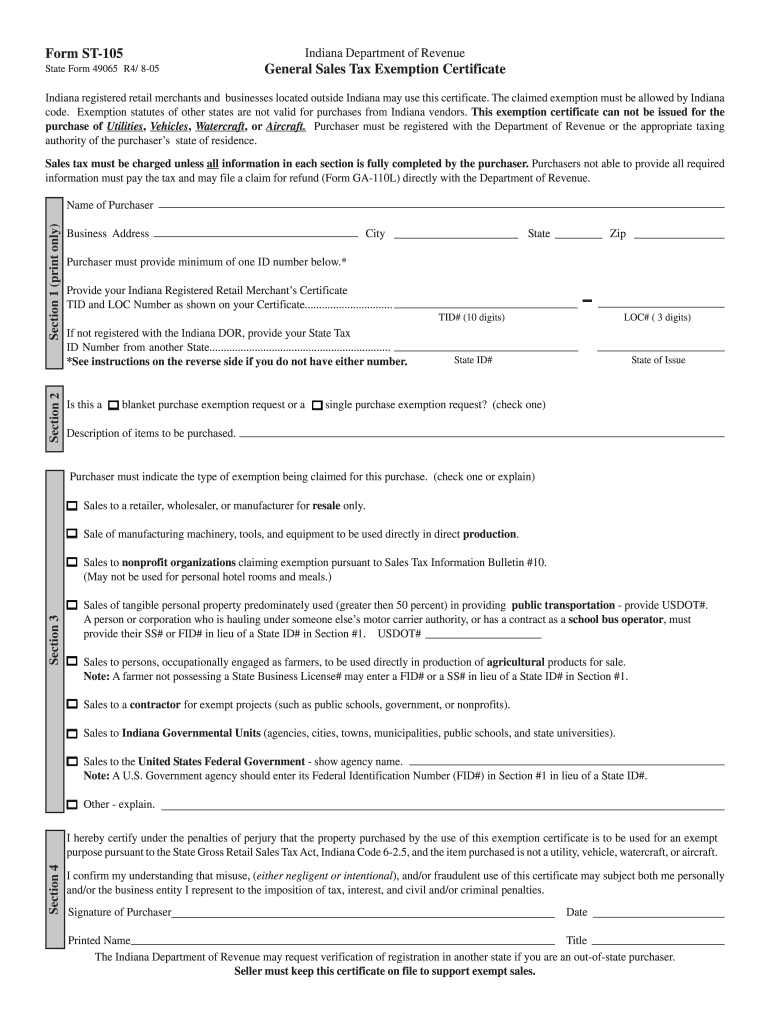

St105 Fill Online Printable Fillable Blank Pdffiller

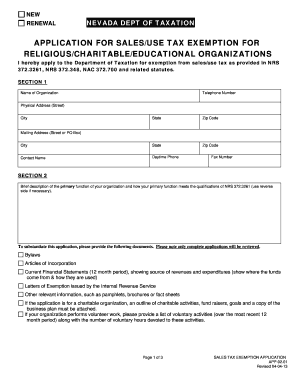

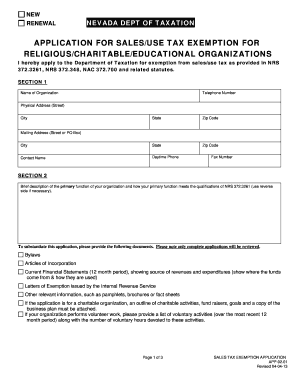

Nv Exemption Fill Out And Sign Printable Pdf Template Signnow

How To Get A Resale Certificate In Connecticut Startingyourbusiness Com

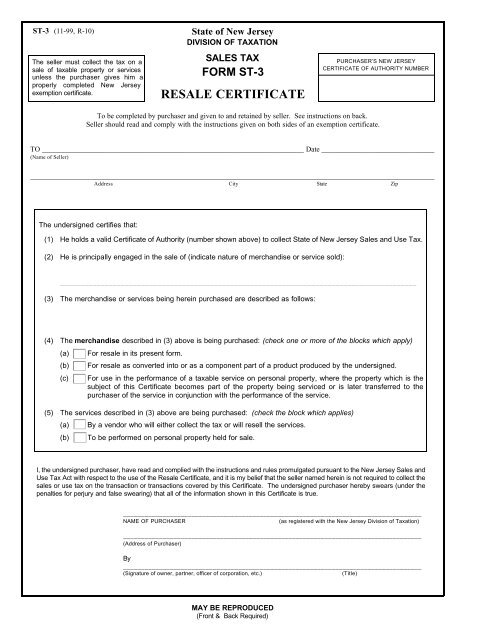

Sales Tax Form St 3 New Jersey Resale Certificate Pdf4pro

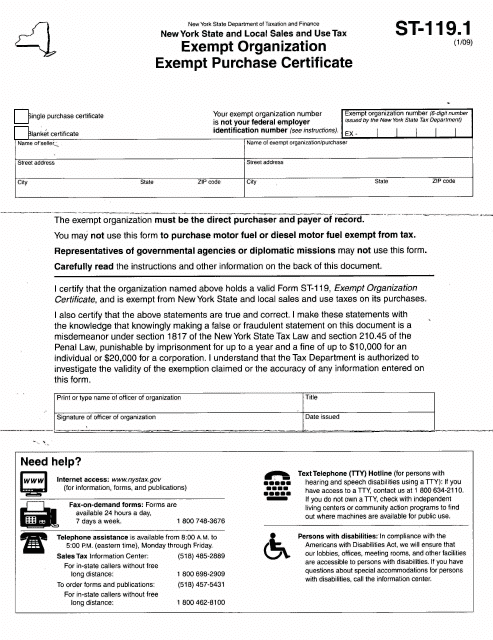

Form St 119 1 Download Fillable Pdf Or Fill Online New York State And Local Sales And Use Tax Exempt Organization Exempt Purchase Certificate New York Templateroller

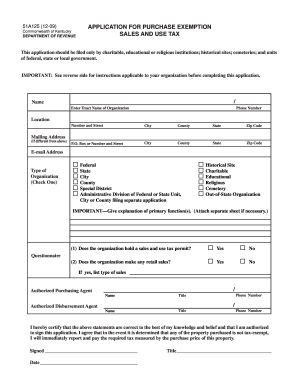

Kentucky Exemption Tax Form Fill Out And Sign Printable Pdf Template Signnow

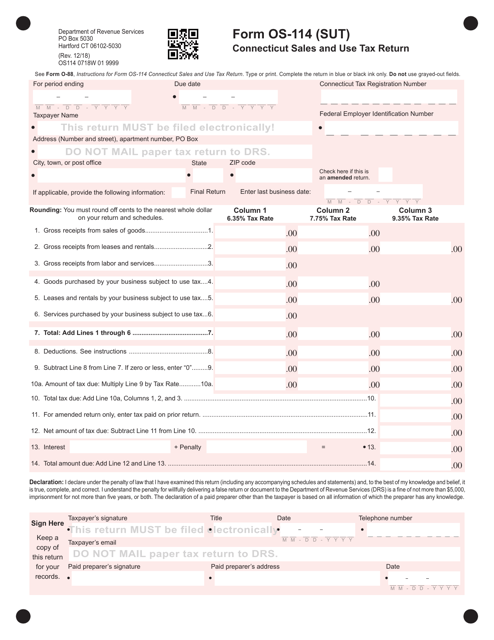

Form Os 114 Sut Download Printable Pdf Or Fill Online Connecticut Sales And Use Tax Return Connecticut Templateroller

Form Cert 141 Fillable Contractors Exempt Purchase Certificate

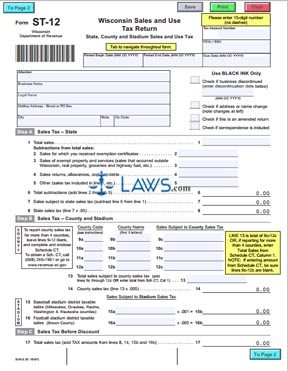

Free Form St 12 Sales And Use Tax Return Free Legal Forms Laws Com